Let’s face it: Saving money feels impossible right now. With groceries, gas, and rent climbing higher every month, putting aside $500 for an emergency can feel totally out of reach. But here’s the good news: you don’t have to do it all at once.

Saving just a little at a time, even a few dollars here and there, really adds up. When you break down your goal into small, manageable steps, it feels way less overwhelming and way more doable.

Tiny habits lead to big results.

How to Get Started

The first step to reaching your savings goal? Write it down!

Tracking your progress makes your goal feel real, and that’s where savings challenges come in. They turn saving into a game, not a chore. Whether it’s coloring in a tracker or stuffing cash envelopes, adding a little creativity makes the process way more exciting—and keeps you motivated to stick with it.

Where to Find the Extra Cash (Without Working More)

If your budget already feels tight, you might be wondering, “Where is this money supposed to come from?” You don’t need a second job to start filling that envelope. Here are three quick ways to “find” money in your current budget:

- The Digital Detox: Check your bank statement for subscriptions you barely use. That $12.99 streaming service or that $5 app subscription? Cancel it today, withdraw that amount in cash, and put it straight into your envelope.

- Shop Your Home: We all have things lying around that we don’t need. Spend 30 minutes decluttering your closet or garage. Listing just one jacket on Poshmark or a few household items on Facebook Marketplace can easily generate your first $20 to $50.

- The Generic Swap: For one week, challenge yourself to swap name-brand groceries for the generic store brand. It might only save you $0.50 here and $1.00 there, but at the checkout line, those savings add up. Take the difference in cash and feed your fund.

Tools to Start Your Journey

You don’t need any fancy apps or expensive planners. In fact, you probably have everything you need lying around the house right now:

- Pen & Paper: To write down your specific goals and track your wins.

- Your First Dollar: You have to start somewhere!

- An Envelope: To keep your savings safe and separate from your spending money.

Why Cash?

For this envelope savings challenge, we are keeping things offline. Switching to physical cash is a game-changer. When you have to hand over bills physically, the money feels “real,” making it much harder to dip into the funds for things you don’t truly need.

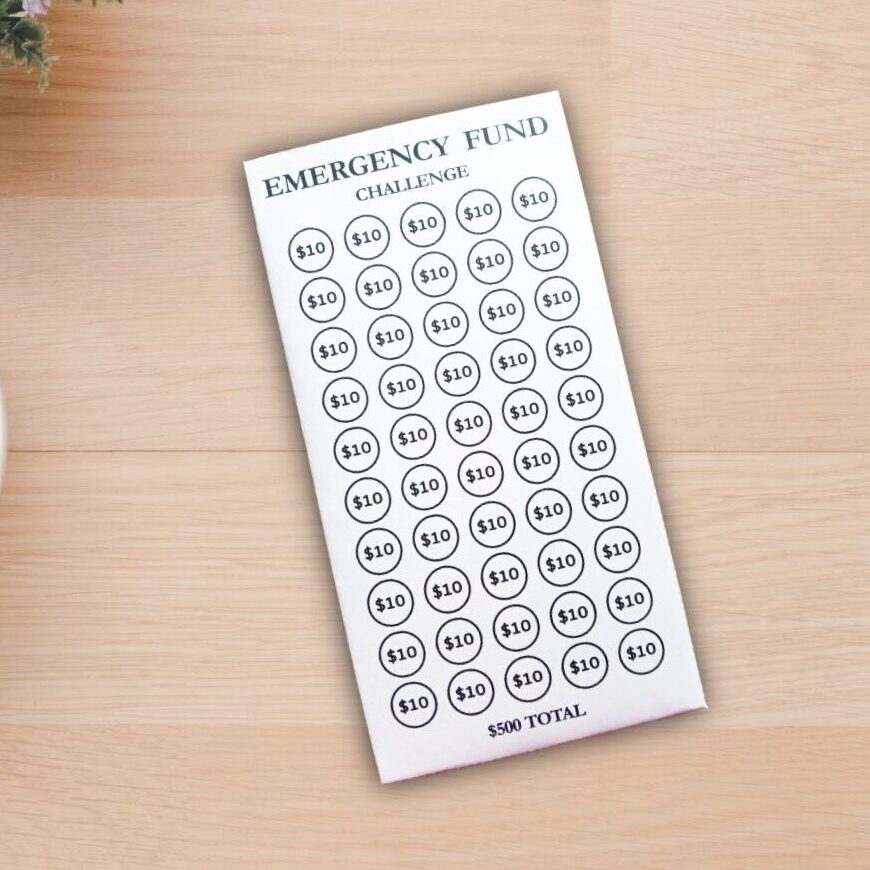

The One-Envelope Strategy

To start your $500 Emergency Fund, grab a single envelope and follow these steps:

- Label the front with your goal: “$500 Emergency Fund.”

- Record your deposits on the back of the envelope or use a separate tracker.

That’s it—just one envelope, a few dollars at a time, and a little discipline. Stay consistent and watch how fast those small bills stack up to a $500 victory.

Ready to hit your savings goals? Download my Emergency Fund Challenge Printable Envelope for free!

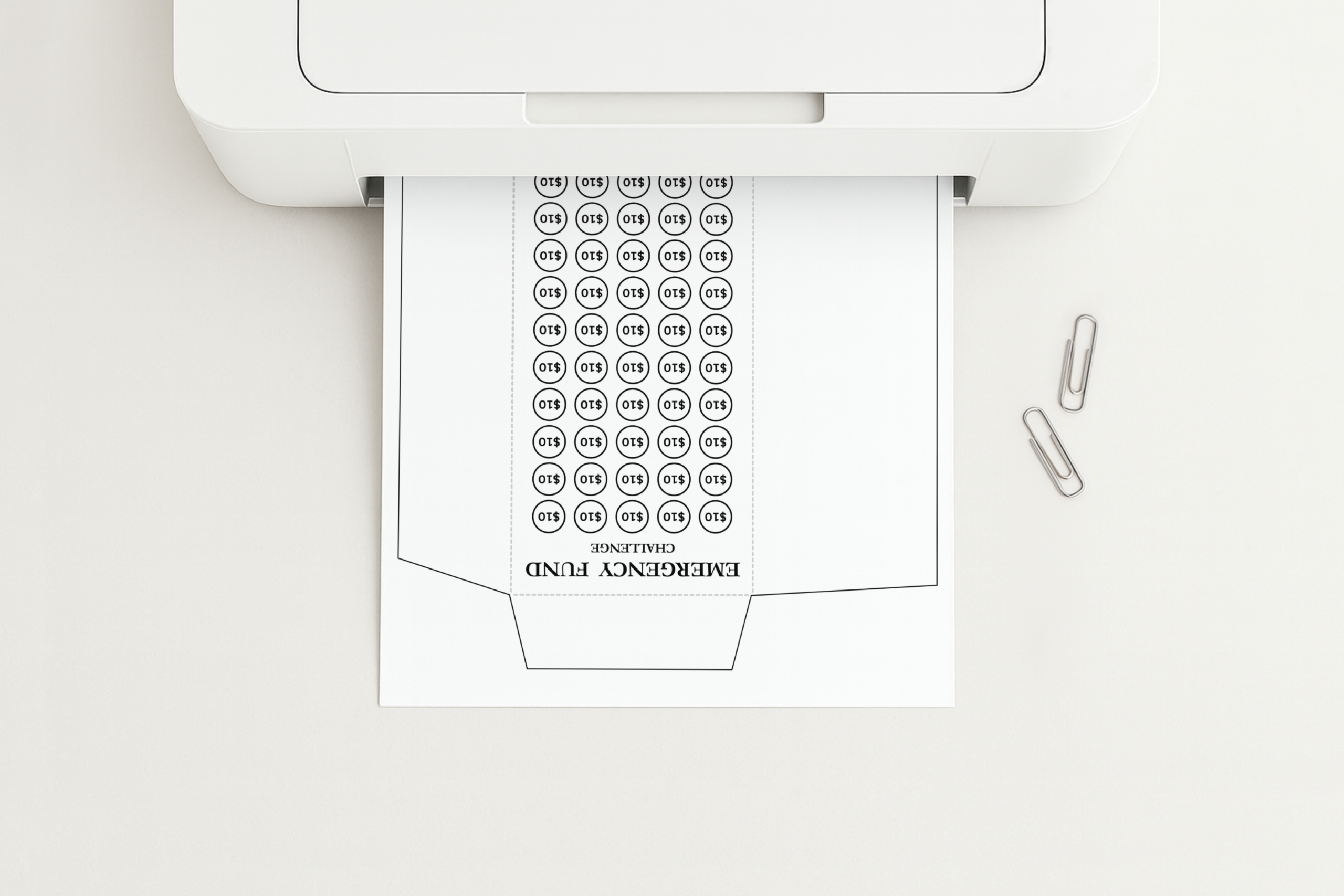

Printing and Assembling Your Envelope

Follow these instructions to turn your free digital download into an envelope you can use.

- Print Your Design: Open your PDF and check your printer settings. Select “Actual Size” (or 100% scale) to ensure the dimensions are correct, and set your orientation to Landscape. While regular printer paper works, I recommend using cardstock for a more durable envelope.

- Cut Out the Template: Use scissors or a paper trimmer to carefully cut along the solid outer line of the envelope template.

- Fold the Flaps: Fold the flaps along the dashed lines. Start by folding the two side flaps inward, then fold the bottom flap up to meet them. Finally, fold the top flap down—this will be your envelope’s opening.

- Glue Your Envelope: Apply a thin line of glue or double-sided tape to the edges of the side flaps, then press the bottom flap firmly onto them. Be careful not to get glue inside the envelope, so your cash won’t get stuck.

Building a new habit is a journey. Stay consistent, stay focused, and enjoy the feeling of watching your emergency savings grow with every bill you save.

Don’t be a stranger! I’m constantly adding new free printables to the blog, so bookmark this page to come back and visit.